Healthcare spending accounts (HSAs) continue to grow in popularity. An HSA benefit combines the flexibility employees prefer, with the cost control small businesses need. Whether you’re starting a new benefits plan for your business, or you’re looking to add to your existing plan, here’s what you should know about HSAs.

What is a Healthcare Spending Account?

A healthcare spending account is a type of Private Health Services Plan that provides coverage for eligible medical and dental expenses for you and your employees. When you set up an HSA plan for your business, you’ll choose a fixed annual funding amount for each class of employees. These funds are used to pay medical and dental claims for you and your employees throughout the year.

Why is an HSA plan the right choice for my business?

An HSA plan combines maximum flexibility for your employees with strict cost control for your business. Your employees get to choose how to spend their healthcare dollars based on their personal or family needs. You’ll get a benefits plan that fits your budget without having to micromanage the coverage details of a conventional plan (e.g. per-visit maximums, dispensing fee caps, etc.) Best of all, because you choose the annual benefit amount, you’ll never need to worry about renewal increases.

How will my HSA plan work?

Funds are deposited into the plan monthly. You and your employees submit expenses to be paid through the plan. Claims are paid based on available funds, up to the annual maximum in each employee’s account. The plan pays 100% of eligible expenses with no co-payments or deductibles. It’s important to note that in the case of coordination of spousal benefits with another plan, an HSA plan always pays last.

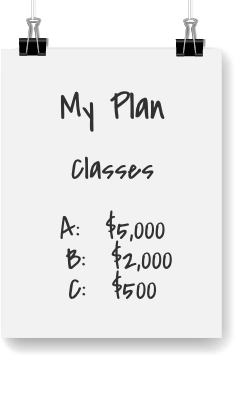

What will my HSA plan cost?

As a business owner, you’ll choose the annual budget for your plan, and deposit funds on a monthly basis for claim payments and administration fees. You’ll receive a monthly invoice detailing per-employee costs and applicable taxes. The full cost of the benefits plan is a tax-deductible expense to your business. Claim payments that employees receive from the HSA plan are tax-free.

What expenses are eligible under an HSA plan?

Medical practitioners like registered massage therapists, chiropractors, and physiotherapists

Prescription drugs and diabetic supplies (excluding over the counter medications)

Medical appliances like mobility aids, and orthopedic shoes

Eyeglasses, contact lenses, and corrective laser eye surgery

Dental services like crowns and orthodontia

Tutoring services for learning or intellectual disabilities

A full list is available on the CRA website

What expenses are normally not eligible under an HSA plan?

Strictly cosmetic procedures like teeth whitening

Athletic or fitness club fees

Non prescription birth control devices

Over-the-counter medications, vitamins, and supplements, even if prescribed by a medical practitioner